What Is COUPDAYS Excel Function?

COUPDAYS Excel function that calculates the number of days in a coupon or interest period between two specified dates. This function is particularly useful in financial models and analysis where accurate calculations of bonds, treasury bills, or dividend payments are required. COUPDAYS takes into account various factors, such as the day count basis and whether the end date falls within a coupon period.

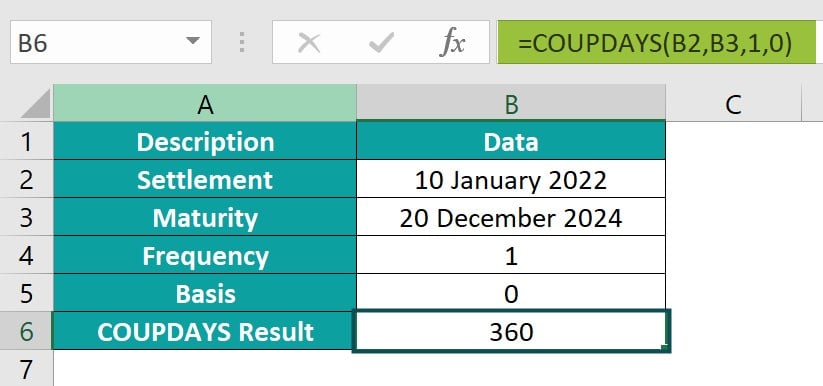

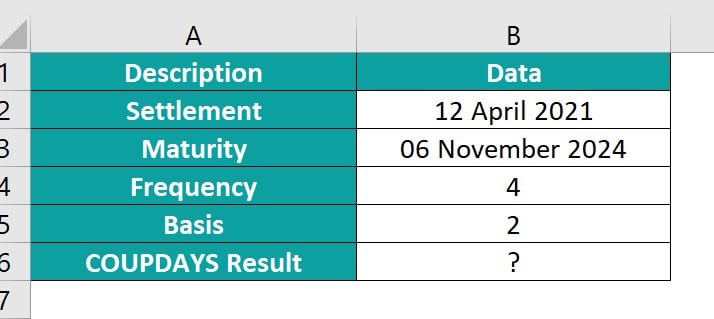

The following example shows us how the COUPDAYS Excel function works. Coupons are given to the issuer to receive interest payments. The COUPDAYS Excel function calculates the number of days in a coupon period that includes the settlement date. We have the required details like settlement and maturity date, the frequency and basis in the given table. Let is now use the formula for COUPDAYS Excel.

To apply the formula, simply enter it in cell B6, as shown below.

=COUPDAYS(B2,B3,1,0)

Once you’ve done that, the resulting value will be displayed in cell B6.

Table of contents

Key Takeaways

- The COUPDAYS function calculates the days between the settlement and the last coupon payment dates.

- The syntax of the function is;

=COUPDAYS(settlement, maturity, frequency, basis).

- The function helps financial analysts determine the accrued interest by multiplying the output with the coupon rate.

- By providing the arguments as settlement date, maturity date, frequency of coupon payments, and basis for counting days in a year, this function returns the precise number of days that fall within the defined period.

- Using COUPDAYS facilitates accurate calculations for interest income accruals and yield calculations and can help financial professionals track cash flows efficiently. Its versatility and accuracy make it an essential tool for performing complex financial analyses in Excel.

Syntax

- Settlement – (Mandatory) This is the settlement date of the security.

- Maturity – (Mandatory) This is the maturity date of the security.

- Frequency – (Mandatory) This is an integer that represents the number of coupon payments per year. This integer must have a value of 1- annual, 2- semi-annual, and 4- quarterly.

- Basis – (Optional) This is the integer that specifies the day count basis to be used. The argument must have values:

- 0 (or omitted): US (NASD) 30/360,

- 1: actual/actual,

- 2: actual/360,

- 3: actual/365,

- 4: European 30/360.

How To Use COUPDAYS Function in Excel?

To utilize the COUPDAYS function in Excel, follow these steps.

#1 – Access from the Excel ribbon

- Find the cell where the result will be displayed. Begin by selecting an empty cell. Then, select the “Formulas” tab.

- To unlock features, Just stroll over to the menu and tap on the Financial option.

- Go to the drop-down menu and choose the COUPDAYS option.

- The Function Arguments dialog box opens. Enter the values for the arguments in the “settlement,” “maturity,” “frequency,” and “basis” fields. Click on the OK button to continue.

#2 – Enter the worksheet manually

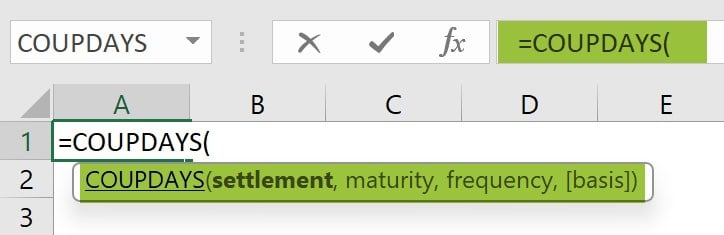

Step 1: Input the formula “=COUPDAYS()” into any desired empty cell. Alternatively, you may type “=C” and double-click on the COUPDAYS function from the list of suggestions offered by Excel.

Step 2: Enter the required arguments, close the braces and press the Enter key.

Examples

Example #1

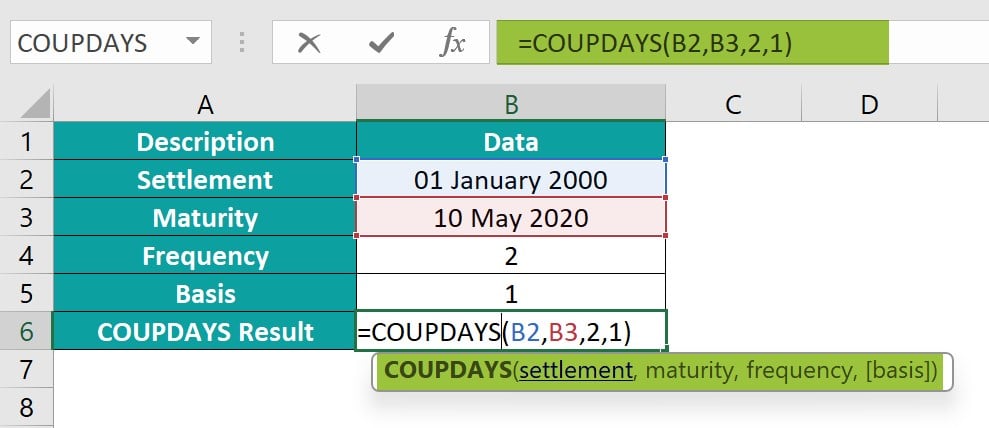

IN the example below, we calculate the number of days in the coupon payment for a 20-year bond purchased on January 1, 2000, with a maturity date of May 10, 2020, and semi-annual coupon payments. For this scenario, the COUPDAYS Excel function comes in handy.

From the given table, the first coupon table

The calculation of the example is defined below:

Step 1: Enter the comprehensive COUPDAYS Excel formula in the designated cell:

= COUPDAYS(B2, B3, 2, 1)

Step 2: The result will be instantly displayed in cell B6.

When the COUPDAYS Excel formula is used to calculate coupon days, it returns the number of days in the coupon period that contain a specified settlement date and maturity date. The formula calculates the number of days between these two dates, excluding weekends and holidays.

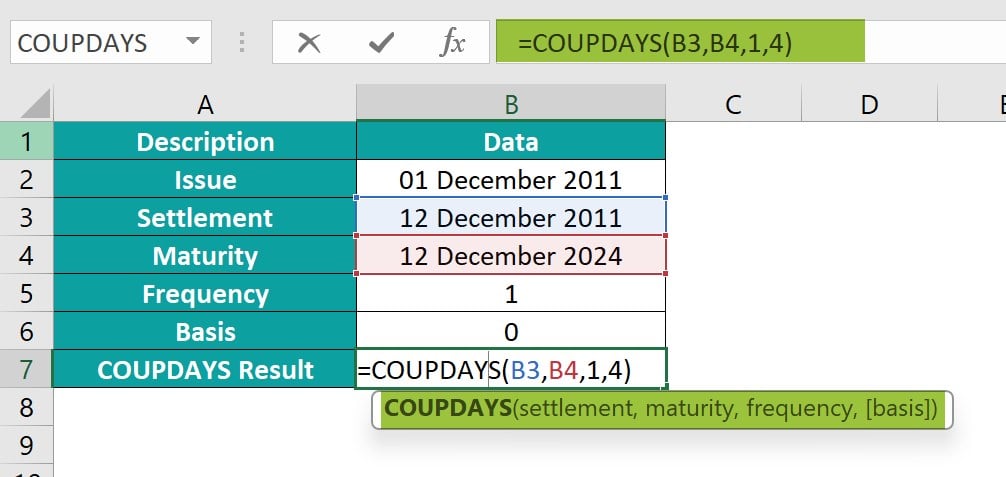

Example #2

In this example, we have all information related to a security such as its issue date, settlement date and the maturity date. It pays quarterly and the basis is 0. For the uninitiated, the date on which the investor takes possession of a security is called settlement date. Let us count the number of days in the coupon period which includes settlement date.

In order to enhance the efficiency, enter the COUPDAYS Excel formula as shown below:

Step 1: Input the COUPDAYS Excel formula in the specified cell:

=COUPDAYS(B3, B4, 1, 0)

Step 2: The result is shown in cell B6 as 360.

Example #3

To calculate the number of in the coupon period for a bond purchased on April 12, 2021, with coupons paid twice a year, use the COUPDAYS formula as shown below.

Step 1: Get started by choosing cell B6 and enter the COUPDAYS formula in that cell:

=COUPDAYS (B2, B3, 4, 2)

Step 2: The output in cell B6 is illustrated below.

The COUPDAYS formula is often used in finance to figure out accrued interest on bonds and fixed-income securities.

Important Things To Note

- The Error #NUM! will occur if the settlement date is greater than or equal to the maturity date, if the frequency argument is not 1, 2, or 4, or if the basis argument is not 0, 1, 2, 3, or 4.

- The Error #VALUE! will occur if the settlement date or maturity date provided are not valid Excel dates or if any of the arguments are non-numeric. It is important to ensure that all dates are entered correctly and that all arguments are numeric to avoid encountering this error.

- The COUPDAYBS Excel function calculates the number of days from the start of a coupon period to a settlement date, helping determine accrued interest for bond investors.

- COUPDAYS only needs settlement date, maturity date, and frequency of interest payments, while COUPDAYBS also needs start and end dates to calculate coupon days within a specific range.

Frequently Asked Questions (FAQs)

The COUPDAYS function in Excel is used to calculate the number of days in the coupon period containing a specified settlement date. In financial terms, a coupon period refers to the length of time between two interest payments for a bond or other fixed-income security. By using the COUPDAYS function, financial professionals can accurately determine the duration of this period and assess how it may impact payment schedules or investment decisions.

Let’s dive into an example to understand the errors that can pop up when using the COUPDAYS Excel function. The table we have here presents a bunch of values in a dataset that we can analyse.

To make use of the formula, it’s as easy as typing it in cells B6 F6, like this:

= COUPDAYS(B2,B3,B4,B5) in cell B6, which might cause a #NUM! error because rate < 0 value

= COUPDAYS(F2,F3,F4,F5) in cell F6, which might cause a #VALUE error because wrong date format of issue date.

The result right away in cells B6 to F6. This will give us some valuable insights to dig deeper and interpret the data.

The limitations of using the COUPDAYS function in Excel are;

• The COUPDAYS function assumes that each coupon period has an equal number of days, which may not always be the case for bonds with irregular cash flows.

• This function does not account for any holidays or weekends that fall within the coupon period, potentially leading to inaccuracies in the calculation.

Download Template

This article must help us understand the COUPDAYS Excel Function’s formula and examples. You can download the template here to use it instantly.

Recommended Articles

Guide to COUPDAYS Excel Excel Function. Here we explain how to use COUPDAYS function with examples & downloadable excel template. You can learn more from the following articles. –

Leave a Reply