What Is AMORDEGRC Excel Function?

The AMORDEGRC Excel function calculates the depreciation of an asset over a specific time, considering the initial cost and salvage value. It is commonly used in accounting and financial analysis in French Accounting System to determine the decline in the value of tangible assets. Users input the cost, salvage value, life duration, and period number to compute the depreciation expense. It helps businesses make informed decisions about asset management and financial planning.

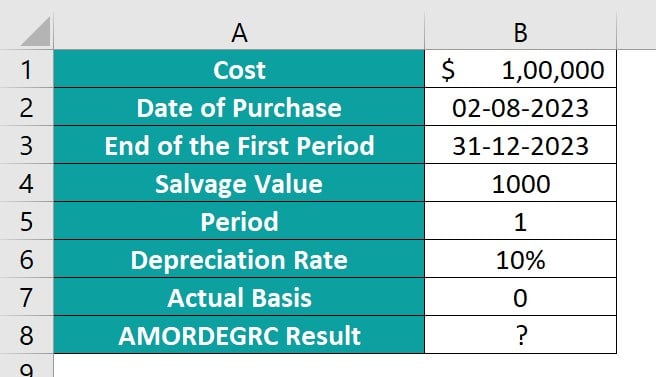

Let us look at a simple example to understand more about the AMORDEGRC Excel function. In this example, we have the cost of a bike and the date of purchase as 2 August 2023.

Apply the following formula to attain the result as shown in the below image.

=AMORDEGRC(B1,B2,B3,B4,B5,B6,0)

Table of contents

Key Takeaways

- The Excel AMORDEGRC function calculates the depreciation of an asset based on its lifespan and depreciation coefficient.

- The syntax of the AMORDEGRC function is =AMORDEGRC(cost, date purchase, first period, salvage, period, rate, [basis]).

- The AMORDEGRC Excel function in Excel plays a critical role in financial analysis, particularly in calculating the depreciated cost of an asset over time.

- Businesses that use this function are able to accurately determine the declining value of their assets while adhering to generally accepted accounting principles (GAAP).

Syntax

- Cost – (Mandatory) This is the asset cost price.

- Date_purchased – (Mandatory) This is the asset purchase date.

- First_period – (Mandatory) This is the asset’s first-period end date.

- Salvage – (Mandatory) The asset salvage value.

- Period – (Mandatory) It is the asset period for which depreciation is calculated.

- Rate – (Mandatory) The asset rate of depreciation.

- Basis – (Optional) This is the asset day count basis.

| Basis | Day Count Basis |

|---|---|

| 0 | US(NASD) 30/360 |

| 1 | Actual/actual |

| 2 | Actual/360 |

| 3 | Actual/365 |

| 4 | European 30/360 |

How To Use AMORDEGRC Function in Excel?

Enter the worksheet manually

To productively employ the AMORDEGRC function in Excel, follow these steps.

- Enter “=AMORDEGRC()” in any desired cell. We can also type “=A” and then double-click on the “AMORDEGRC” function from the list shown by Excel.

- Enter the values of the arguments for the function. Close the braces and press the “Enter” key.

Note: The depreciation methods of the French accounting system have been changed; hence, this function is no longer used. It is only retained for compatibility with old workbooks where the French accounting system may have been used.

Examples

Example #1

The way the AMORDEGRC works is by applying a depreciation co-efficient based on the asset’s lifetime. In this example, there is an asset worth $2,500 with a depreciation rate of 15%. The asset was purchased on April 20, 2022, and the first depreciation period starts after December 31, 2022. The salvage value of the asset is 200. Now, we are calculating the depreciation at the end of the first period.

Step 1: Select cell B8 and enter the AMORDEGRC formula. Here, we are giving the reference values of the data stored in the table. Remember the dates should be in the DATE format and not as text as it could lead to problems in calculation. Else when using the date values in the formula, you may use the DATE excel function.

= AMORDEGRC(B1,B2,B3,B4,B5,B6,1)

Step 2: Press Enter. The outcome is showcased in cell B8.

This formula calculates depreciation over a specific period for an asset worth $2,500.

By passing the required arguments, the formula determines the depreciation of the asset. It applies the depreciation coefficient to calculate the depreciation at $692 for the period from April 20, 2022 to December 31, 2022.

Example #2

An asset was bought for $5,000 on January 1, 2000. By December 31, 2005, its value depreciated by 5% per year, and its estimated salvage value was 500. Let us calculate its new value at the end of the first period.

Step 1: To use the AMORDEGRC formula, select cell B8 and enter the formula as shown.

= AMORDEGRC(B1,B2,B3,B4,B5,B6,0)

Step 2: Press enter to see the result in cell B8.

Note: Microsoft Excel stores dates as sequential serial numbers starting from January 1, 1900. Each day is represented by a number, with January 1, 1900, being 1 and January 1, 2008, being 39448 since it is 39,448 days after January 1, 1900. The dates given in the table should be in the Date format or as serial numbers.

Example #3

We have an example of an asset that was bought for $45,000 on May 7, 2021, and is expected to last for several years. The end of the first period is December 31, 2022, and its rate of depreciation is 10% per year with an estimated salvage value of 1000. Calculate the depreciation of this asset at the end of each accounting period from 0 to 4.

Let’s start the calculation by entering the values from the table.

Step 1: Insert the formula to calculate the depreciation of the asset in cell E2 initially.

=AMORDEGRC($B$1,$B$2,$B$3,$B$4,D2,$B$5,3)

Here, we use the absolute cell references for values which remain fixed for all the periods.

Step 2: Press Enter. You get the depreciation value for period 0.

Step 3: Drag the Autofill handle to calculate the AMORDEGRC Excel value for periods through 0 to 4. The depreciation value is attained in cells E2 to E6.

Important Things To Note

- AMORDEGRC will return #VALUE error if any of the dates provided are invalid.

- AMORDEGRC Excel will return #NUM if the cost is less than or equal to the salvage value, the rate is less than or equal to 0, the basis is not between 0 and 4, or the asset life is not within the ranges of 0-1, 1-2, 2-3, 3-4, or 4-5 years.

- This function calculates depreciation until the end of the asset’s life or until the total depreciation exceeds the asset’s cost minus salvage value.

- The depreciation rate will increase to 50% for the period before the last period and then increase to 100% for the last period.

- This is essential for ensuring the accuracy and integrity of financial statements, as well as for making informed decisions on asset investments and management.

- The AMORDEGRC Excel function allows users to calculate depreciation using a flexible method that takes into account factors such as salvage value, useful life, and the period in which the asset was acquired.

- Businesses may risk inaccuracies in their financial reporting and ultimately compromise their credibility with stakeholders.

Frequently Asked Questions (FAQs)

The AMORDEGRC function in Excel is a financial function used to calculate the depreciation of an asset over time. Specifically, it calculates the prorated depreciation of an asset based on a variable rate over a specified period.

The AMORDEGRC function streamlines the process of calculating depreciation expenses and provides more flexibility in capturing the true economic impact of asset deterioration over time in financial reporting.

The limitations of using the AMORDEGRC function are;

• This function may not be suitable for assets where complex depreciation methods are more appropriate. It primarily supports the straight-line and declining balance depreciation methods.

• The AMORDEGRC function requires specific input parameters, such as the cost of the asset, salvage value, and life of the asset. If any of these parameters are missing or incorrect, the function will return an error. Hence, a thorough knowledge of financial concepts is required.

• It is not suitable for scenarios where you may have to apply different depreciation methods for different periods.

When using the AMORDEGRC function in Excel, there are several common errors that users should be aware of to ensure accurate results.

• One key error to watch out for is inputting the arguments incorrectly, as this can lead to incorrect calculations.

• Users should pay attention to the conventions for specifying dates and interest rates, as failure to do so can result in inaccurate output. It is also important to ensure that all relevant parameters, such as settlement date, maturity date, issue date, and redemption value, are correctly included in the function.

The example shows the occurrence of #NUM! Error using the AMORDEGRC Excel function.

Enter the formula = AMORDEGRC(B1,B2,B3,B4,B5,B6). The result is shown in the cell B7.

The #NUM! error occurred because the purchase date entered is after the First Period date, which can’t be possible.

Download Template

This article must help us understand the AMORDEGRC Excel Function’s formula and examples. You can download the template here to use it instantly.

Recommended Articles

Guide to AMORDEGRC Excel Function. Here we explain how to use AMORDEGRC function with examples & downloadable excel template. You can learn more from the following articles –

Leave a Reply